Nesting Isn’t Just for the Birds!

By M.C. Dwyer

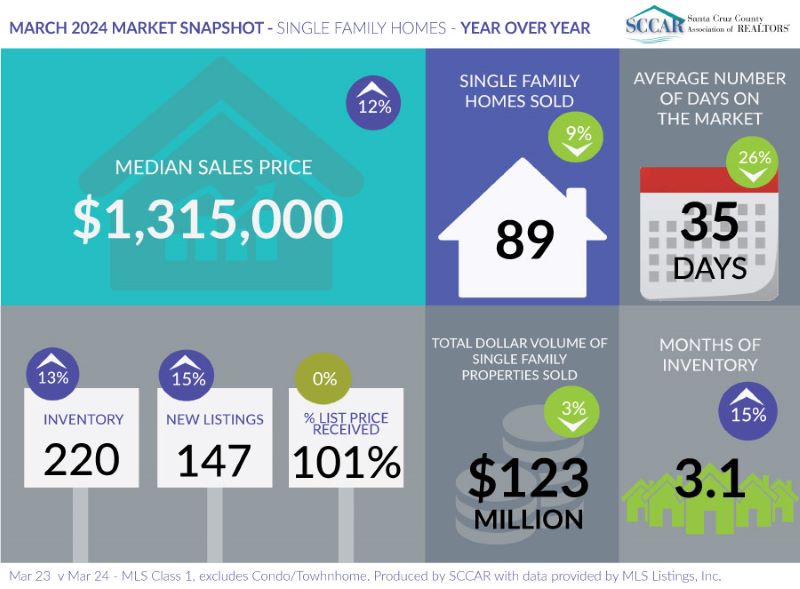

Like the instinct that drives birds to nest each spring, many people feel some kind of internal drive kicking in this time of year, and the housing market is shaking off the cold of winter and coming back to life. Despite an average sales price of $2,000,000 (!), the pace of Santa Clara County home sales was about 50% faster than the previous winter. Santa Cruz County’s pace this last winter experienced a normal seasonal slowdown. Still, we had about 10% more sales than last year. Although Santa Clara’s prices rose about 10% over last year, Santa Cruz home prices are relatively “on sale” as average prices are 6% lower than last year.

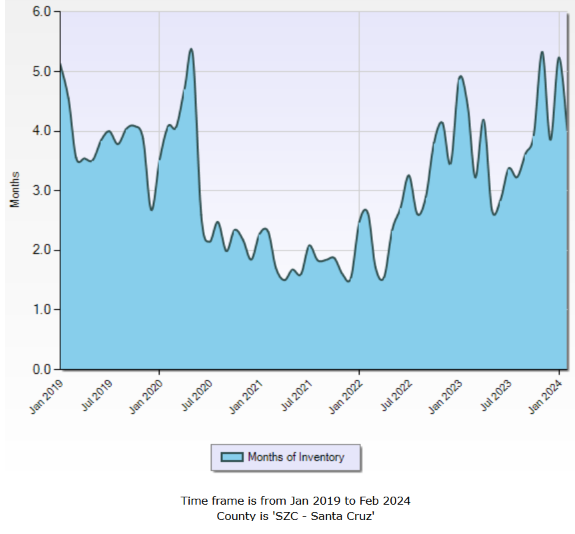

Redfin reports more homes on the market this spring — the first increase in the last eight months. More buyers are touring homes, and loan applications are up over 10%. This brings the national supply of homes up to 3.7 months — approaching a balanced market between buyers and sellers after years of being a strong sellers’ market.

Designating Who Will Inherit Your Home

Following last month’s column about probate and trusts, there is a simpler and less expensive method to transfer residential real estate to your heirs that’s been around for about 8 years in California: it’s called the Transfer on Death (TOD) Deed. Consult an attorney about your estate plans, but this document is available from most County Recorders’ offices. It’s revocable, meaning the property owner can change their mind. It needs to be simultaneously witnessed by two people and filed at the County within 60 days of the signing.

First Time Buyers

I got into real estate for many reasons, but key was the desire to help people establish the kind of financial security I saw everyone in my middle class family building. Today, only about 15% of Californians can afford to buy a home. Zillow reports that nationally, home prices have gone up about 40% since before the pandemic and that shoppers need to make about $110,000 a year to buy a home. Here in California, it’s no surprise that income requirements are higher: the major metros like San Francisco/Los Angeles/San Diego require about $200,000 in income, but San Jose metro home buyers need $450,000 income (!) to qualify for a loan on an average priced home. This continues to ensure demand for our (relatively) lower-cost housing in the Santa Cruz Mountains region.

Millennials, the largest demographic group at 77 million people, are in their key household formation years. But, saving for a 10% down payment can take 8.5-10 years or longer; meanwhile home prices usually keep rising. So, many of today’s first-time home buyers are using stock awards, friends, family (about 20%), and other hacks to get their foot in the door. It’s a myth that a 20% down payment is required: in our rural areas, some people qualify for 0% down, and many qualify for 3.5 – 5% down payment loans.

In response to the affordability crisis, new laws are being proposed and grants are in process to assist first-time buyers who don’t have generational wealth to help them. Last year, the California Dream for All program for first-time home buyers ran out of its $300 million in less than 2 weeks. So this year, there will be a lottery to determine who can participate among the 1500-2000 winners. This program can provide up to 20% down payment with no monthly payments nor interest, to the state. In exchange, when the property is sold, the state gets repaid, plus 20% share of any appreciation.

Recently, President Biden proposed a new pair of tax credits — one for first-time home buyers and one for people who feel stuck in their homes. The home buyer side is the equivalent of lowering mortgage costs by about $400/month for the first two years. The “stuck” home seller side could bring as many as 3 million more affordable homes onto the market. The mechanics proposed are a $10,000 tax credit to offset the fact that home sellers with very low mortgage rates would become buyers at higher mortgage rates. This is an aspirational goal that needs congressional support from both sides. It’s notable that his 2021 housing proposal didn’t become law, but the tax credits during the housing crisis of 2008-2010 helped about 1.5 million first-time buyers.

REALTOR® Compensation

The day before the press deadline, the National Association of REALTORS® announced an agreement to change the method of buyers’ agents’ compensation, subject to court approval. In response to lawsuits initiated in the southeast and spreading across America, where consumers alleged they were unaware of buyers’ agents’ compensation, the new agreement stipulates the use of buyers’ agents’ agreements, similar to sellers’ listing agreements. Compensation has always been negotiable – that’s in bold print in multiple forms that clients sign. Mysteriously, the NAR agreement outlaws the publishing of compensation in MLSs across the states. To me, this hides the compensation, yet the new settlement requires agents to present buyers with the compensation for each property they view. Since buyers view an average of 4-6 properties on any given outing, this would require 4-6 phone calls and follow-up calls to collect all the information, even though now agents can just print the MLS page for their buyers. It’s quite possible that a buyers’ agent might not be able to find the compensation before showing homes! Meanwhile, there’s the conundrum that there may be no compensation offered by the sellers’ agents to the buyers’ agents, which allows buyers to finance the cost of their agent in the loan. Now buyers’ agents will have to separately negotiate their own compensation with each offer written. My main concern is that some buyers may try to save money and not get their own agent. This possibility makes me cringe since buying a home is one of the largest investments most people undertake, and the complexity of understanding the property’s legal status, title, and physical conditions will be lost on the uninitiated. It’s almost like going to court without your own attorney. I’ve heard sad stories about people buying without an agent only to discover trouble. For example, one inherited the sellers’ debts, costing them tens of thousands of dollars, and several found their new property’s condition wasn’t as good as the seller represented. Not to mention the potential for shenanigans such as selling property they don’t actually own.

Send your questions & topics to “M.C.” (MaryCatherine) Dwyer, MBA, REALTOR®

(831) 419-9759 mcd@mcdwyer.com

CA DRE License 01468388 EXP Realty of California, Inc.

Serving San Lorenzo Valley and Scotts Valley since 2005

Sources: California Association of REALTORs, CNN, MLS as of 3/16/2024, Mercury News, Mortgage News Daily, National Association of REALTORs, Redfin, Reuters, Zillow, and County of Santa Cruz.

The statements and opinions contained in this article are solely those of the individual author and her sources, and do not necessarily reflect the positions or opinions of eXp Realty, LLC, or its subsidiaries or affiliates (the “Company”). The Company does not assume any responsibility for, nor does it warrant the accuracy, completeness or quality of the information provided.

Featured photo by Chris Yuan

***

The San Lorenzo Valley Post is your essential guide to life in the Santa Cruz Mountains. We're dedicated to delivering the latest news, events, and stories that matter to our community. From local government to schools, from environmental issues to the arts, we're committed to providing comprehensive and unbiased coverage. We believe in the power of community journalism and strive to be a platform for diverse voices.